TABLE OF CONTENT

Corporate Information

Board of Directors

David G. Tetteh (Chairperson)

Victor Kodzo Avevor

Cynthia Eyram Ofori-Dwumfuo

John Asante

Gilbert Odartey Hansen (resigned on 22 November, 2023)

Company Secretary

Nathan Tete Tei

T2, Manet Ville, Spintex, Accra

Fund Manager

Ashfield Investment Managers LTD

The Investment House

18 Noi Fetreke Street, Accra, Ghana

Custodian

Standard Chartered Bank PLC

P.O. Box 768, High Street, Accra, Ghana

Registered Office

The Investment House

18 Noi Fetreke Street, Airport West, Accra

Auditors

UHY Voscon Chartered Accountants

2nd Floor, Cocoshe House

Opposite Silver Star Tower

Agostinho Neto Close, Airport Residential Area, Accra, Ghana

Bankers

Standard Chartered Bank PLC

GCB Bank PLC

Chairman’s Statement

To Shareholders

Dear Valued Shareholders,

On behalf of the Board of Directors, I warmly welcome you to the 2023 Annual General Meeting of our Fund. I extend my gratitude for your support and interest in the Fund. This year, the global economy faced a mixed performance due to lingering challenges such as inflation, geopolitical tensions, and weak demand.

Highlights:

-

Global economic growth slowed to 3%, with developing markets showing resilience.

-

Inflation declined from 8.8% in 2022 to 6.8% in 2023 due to tighter monetary policies.

-

Ghana experienced a GDP growth of 2.9% and a sharp reduction in inflation from 54.1% to 23.2%.

Looking ahead to 2024, we remain optimistic about navigating the challenging environment through disciplined management and strategic investments.

Fund Manager’s Report

Portfolio Review

The Gold Money Market Fund PLC aims to provide enhanced liquidity, income growth, and wealth preservation through investments in high-quality short-term securities.

-

Fund Performance: Assets under Management grew by 1.96% to GHS 100.95 million in 2023.

-

Shareholder Growth: The Fund recorded 11,629 shareholders by year-end, with Class A share prices increasing from GHS 0.1682 to GHS 0.1841.

Portfolio Breakdown:

-

Government of Ghana securities: 1.44%

-

Cocoa Bonds: 8.75%

-

Certificates of Deposits: 27.5%

-

Money Market Funds: 40.62%

-

Others: 20.73%

Portfolio Review

Performance Summary

Financial Highlights and Summary

Performance Summary

Year-on-Year Returns (Class A Shares):

-

2023: 9.44%

-

2022: 0.79%

-

2021: 0.73%

-

2020: 11.38%

Historical Share Price Performance (Class A Shares):

-

2023: GHS 0.1841

-

2022: GHS 0.1682

-

2021: GHS 0.1594

Report of the Directors

Nature of Business

The Fund invests in money market instruments to provide liquidity, income growth, and wealth preservation for its members.

Portfolio Holdings

Financial Results for the Year Ended 31 December 2023

Corporate Social Responsibility

No corporate social responsibility activities were undertaken in 2023.

Auditor Remuneration

The auditor’s fee for 2023, including applicable levies and VAT, was GHS 30,445.

Corporate Governance Report

Board Composition

The Board consists of experienced financial professionals, ensuring strong governance. The Board size for 2023 included four members:

Board Meetings and Attendance

Financial Statements

Statement of Comprehensive Income

Statement of Financial Position

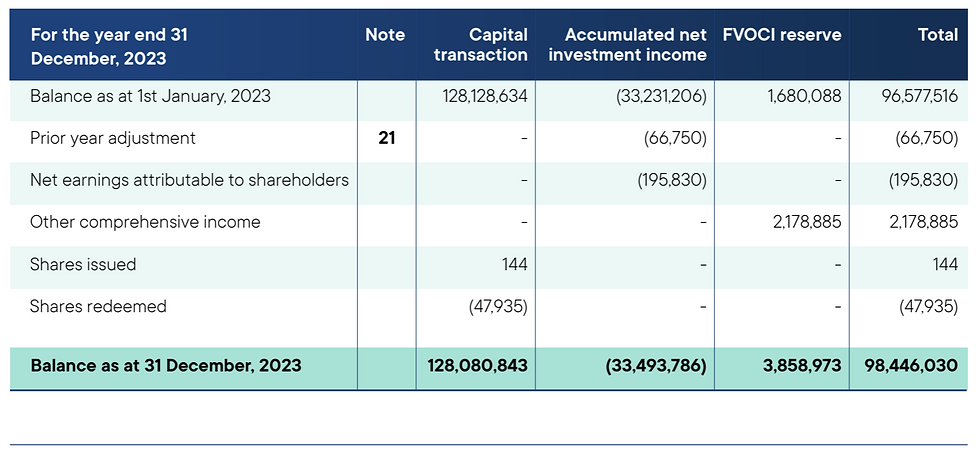

Statement of Changes in Equity

Statement of Movement in Net Assets

Statement of Movement in Issued Shares

Statement of Cash Flows

Report of the Custodian

Standard Chartered Bank PLC acts as the custodian for the Fund, ensuring compliance with regulatory guidelines and safeguarding all financial assets.

Independent Auditor’s Report

The financial statements present a true and fair view of the Fund’s financial position as of 31 December, 2023. The audit was conducted in compliance with International Standards on Auditing (ISAs).

Opinion

Key Audit Matters

-

Verified compliance with the Companies Act 2019 (Act 992) and Securities Industry Act 2016 (Act 929).

-

Confirmed accuracy of financial disclosures and assessed significant risks.

Notes to the Financial Statements

Reporting Entity

The Fund operates as a mutual fund, investing in money market instruments to deliver stable returns and maintain liquidity.

Accounting Policies

-

Financial statements are prepared under IFRS standards.

-

Functional currency: Ghana Cedis (GHS).

-

Valuation methods include fair value and amortized cost models.

Financial Risk Management

-

Market Risk: Managed through diversified investments.

-

Credit Risk: Controlled via investment in high-quality securities.

-

Liquidity Risk: Ensured by maintaining adequate cash and short-term securities.